annuity structured settlements:

annuity structured settlements

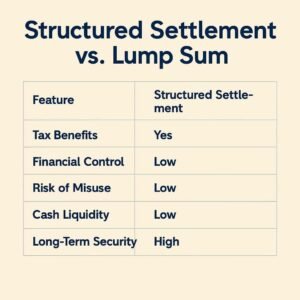

You have two choices:

1.take the plutocrat all incontinent or admit it in lower, harmonious payments over time.

2.This alternate option is called a subvention structured agreement and for numerous, it offers the kind of fiscal peace that a lump sum never could.

annuity structured settlements

In this companion, we will explore everything you need to know about subvention structured agreements, including how they work, their pros and cons, legal aspects, how to vend them, and whether they are the right choice for you in 2025.

An Annuity Structured Settlement: What Is It?

An subvention structured agreement is a licit fiscal arrangement wherein an individual receives recreating payments rather than a one-time payment. These are generally given out as an element of agreements for unlawful death, medical malpractice, or particular injury.

The responsible party, generally the defendant’s insurance provider, buys a subvention from a life insurance provider after the agreement sum has been decided.

The philanthropist of that subvention is assured a harmonious inflow of income.

🔎 When Do They Get Used?

agreements for particular injuries Workers’ compensation cases suits for unlawful death Compensation for severe accidents Following legislation passed by the US Congress that made these payments duty-free under specific circumstances, structured agreements came more and more popular in the 1980s.

Does It Operate Step-by-Step?

Et us anatomize the procedure

1. The parties, or the court decide on an agreement sum..

2.He defendant’s insurer buys a subvention rather than outlaying the entire quantum incrementally.

3.The subvention is intended to pay out over a period of months, times, or eternity.

He agreed-upon periodic payments are made to you, the philanthropist, on a yearly, periodic, or customary base.

annuity structured settlements

⏳ Payment Schedule Types Life-contingent payments for as long as the philanthropist lives Fixed-term payments yearly for ten times, for illustration mongrel periodic income plus sporadic lump totalities for mileposts(e.g., council, buying a home)

Structured agreements’ Advantages

💸 Income Without levies According to the Periodic Payment agreement Act, the maturity of structured agreement payments are pure from civil and state income levies.

CoNserving your fiscal security. It prevents you from making generous purchases. However, this is fantastic, if you are youthful or have not worked with plutocrat much in the history.

🔐 icing Continued profit For times or indeed decades, it can give you with a sound fiscal foundation .

ItS excellent for paying for recreating medical bills or diurnal expenses.

📉 TheE threat of Prices Going Up still, the payments you get each time might not be worth as much over time, If your subvention does not keep up with affectation.

💧 Not Enough Cash To get the complete value of your agreement, you might need to vend it to someone differently, generally for lower than it is worth.

annuity structured settlements

effects That Could Go Wrong When You vend You do not get the full quantum right down – there is a reduction.

YES!You need to get blessing from a court.you need the court’s blessing on this.

If the trade is good for you, which stops people from taking advantage, but it can decelerate effects down.

The rican legal system

Structured Settlement Protection Act governs and protects structured agreements.

To guarantee:ante openness and equity when dealing with an agreement, every state also has its own laws. You have a right to openness and equity when dealing with an agreement.

to unite with court-approved factoring enterprises Get figure, rate, and net quantum exposures.

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice. Always consult with a qualified professional.